With President Trump proposing to slash corporate tax rates, reduce the number of tax brackets, and cut income tax rates for all income categories, the age-old debate over tax cuts and government revenue is once again being played out in the media.

President Obama's former "car czar" and current MSNBC host, Steve Rattner, typified the media treatment of this topic when he complained on "Morning Joe" today that Trump's tax package amounts to "a $5.5 trillion unpaid-for tax cut, relying on the old Reagan doctrine of supply side economics which has been discredited."

On "The Today Show," Savannah Guthrie told Trump's Treasury secretary, Steve Mnuchin, that "tt's a Washington fairy tale" that tax cuts boost revenue.

"This should offend anybody's sense who's ever been to a math class," sniffed CNBC's Andrew Ross Sorkin of the plan's impact on the federal balance sheet. "You'd have to hire David Copperfield to make this work out."

And on and on and on.

So what's the real record?

Rather than deal in projection, here's what's actually happened every time Washington's dramatically slashed marginal tax rates.

1920s Tax Cuts (via Dan Mitchell):

Tax rates were slashed dramatically during the 1920s, dropping from over 70 percent to less than 25 percent. What happened? Personal income tax revenues increased substantially during the 1920s, despite the reduction in rates. Revenues rose from $719 million in 1921 to $1,164 million in 1928, an increase of more than 61 percent.

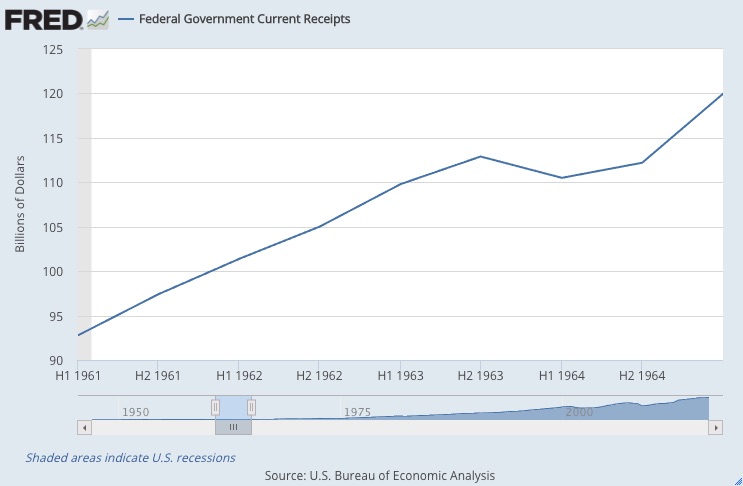

1960s Kennedy Tax Cuts (via Dan Mitchell)

President Kennedy proposed across-the-board tax rate reductions that reduced the top tax rate from more than 90 percent down to 70 percent. What happened? Tax revenues climbed from $94 billion in 1961 to $153 billion in 1968, an increase of 62 percent (33 percent after adjusting for inflation).

Federal revenue during the Kennedy Administration:

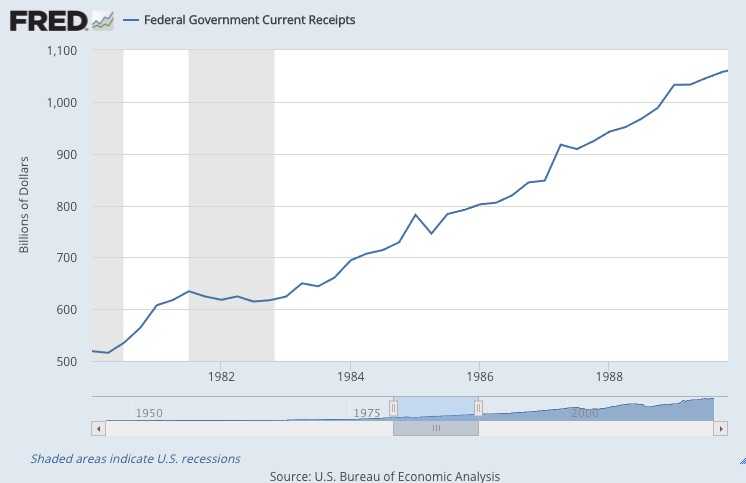

1980s Reagan Tax Cuts (via St. Louis Fed)

In 1981, Reagan passed the "Economic Recovery Act," slashing top marginal rates from 70 percent to 50 and the lowest rates from 14 percent to 11 percent. What happened to government revenue? In 1980, the government collected $517 billion; revenues then increased every year of Reagan's administration, ending in 1988 at $909 billion, an increase of 76 percent.

Federal tax revenue during the Reagan Administration:

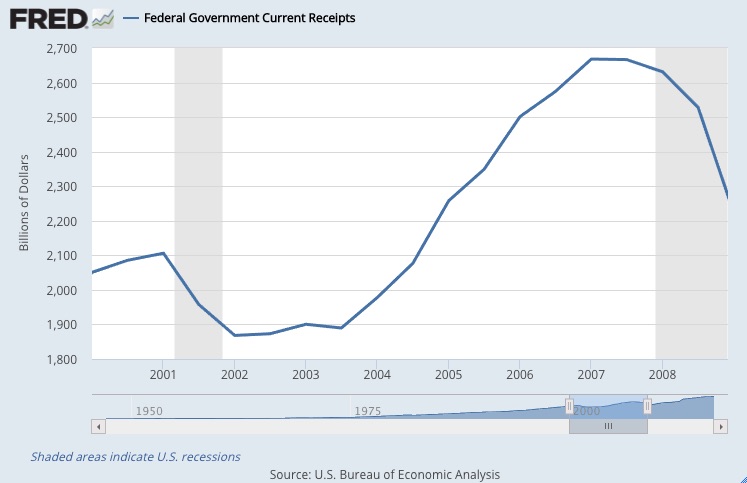

2000s Bush Tax Cuts (via St. Louis Fed)

In 2001, Bush signed a tax reform package that called for lower rates in addition to tax rebates; as the rate cuts were phased in over five years, conservative critics said they weren't impactful enough to meaningfully boost growth. In 2003, Bush passed a second tax cut package that accelerated the rate cuts, and in some cases deepened them. What happened to federal tax receipts? As before, they took off. In 2000, federal taxes receipts totaled $2.03 trillion; in 2008, they totaled $2.52 trillion, an increase of 24 percent.

Federal tax revenue during the Bush Administration:

Of course, the economy is a complex system and it's never possible to point to any singular variable as the sole cause of a particular outcome. Interest rates, terrorist attacks, federal spending, war are just a few factors that also affect the economy. But it's inaccurate to say -- as so frequently happens in the mass media -- that cutting taxes automatically results in less money for the government.

In fact, it's the opposite. If the mainstream media is keen on boosting federal revenue, they ought to start voicing support for President Trump's tax reform package.