Contrary to widespread claims that the U.S. government will default on its debt if Congress doesn’t raise the debt limit, federal law and the Constitution require the Treasury to pay the debt, and it has ample tax revenues to do this.

Nor would Social Security benefits be affected by a debt limit stalemate unless President Biden illegally diverts Social Security revenues to other programs.

The debt limit is a valuable tool for transparency, accountability, and giving voters an ongoing say in how their money is spent.

The U.S. national debt has grown by $8.2 trillion since 2020 and is now $31.5 trillion. This is an average debt of $239,763 for every home in the nation.

Those figures don’t account for the government’s fiscal liabilities and unfunded obligations. When these are included—as government requires in the financial statements of publicly traded corporations—the total federal shortfall is $135 trillion. This is an average burden of more than $1 million per household.

In addition, Biden has proposed a budget framework that will allow the national debt to grow over the next decade by $19.8 trillion, according to his own administration’s projections.

Such levels of red ink have perilous consequences for nearly everyone, like higher inflation, wage stagnation, investment losses, and lower standards of living.

To limit the damage from excessive government debt, House Republicans have passed a bill that would reduce budget deficits by about $4.8 trillion over the next 10 years. This isn’t enough savings to actually pay down the debt but would restrain its growth by about 25% relative to Biden’s agenda. The bill accomplishes this mainly by reducing spending on social programs and “green” energy subsidies.

Biden and the Senate Democrats have said they won’t approve the bill or anything like it. However, they are under pressure to negotiate because the federal government is spending about 22% more than its revenues and has reached the legal limit of its ability to borrow more money. This is called the “debt ceiling” or “debt limit,” a provision of federal law by which Congress exercises its constitutional power to “borrow money on the credit of the United States.”

Biden and the Democrats raised the debt limit by $2.5 trillion in December 2021 when they controlled both the House and the Senate. The Republican bill increases the debt limit by another $1.5 trillion, but in opposition to the Democrats’ stance, Republicans have said they won’t raise the debt limit without including deficit-reducing provisions in the same bill.

The Biden administration has some ability to skirt the debt limit by using “extraordinary measures,” which basically involve shuffling money around. However, these measures are nearly exhausted.

So unless Democrats and Republicans agree on a bill to raise the debt limit within about one month, the federal government will have to cut enough spending to completely stop the growth of the national debt. Or in other words, it will have to operate with a balanced budget.

The U.S. Treasury—which is responsible for managing the national debt— is part of the executive branch of the federal government, which is under the authority of President Biden.

Biden alleges that unless the debt ceiling is raised, the government will “default on its debt” for the “first time” in the history of United States. A default is a “failure to meet a financial obligation,” particularly paying a debt.

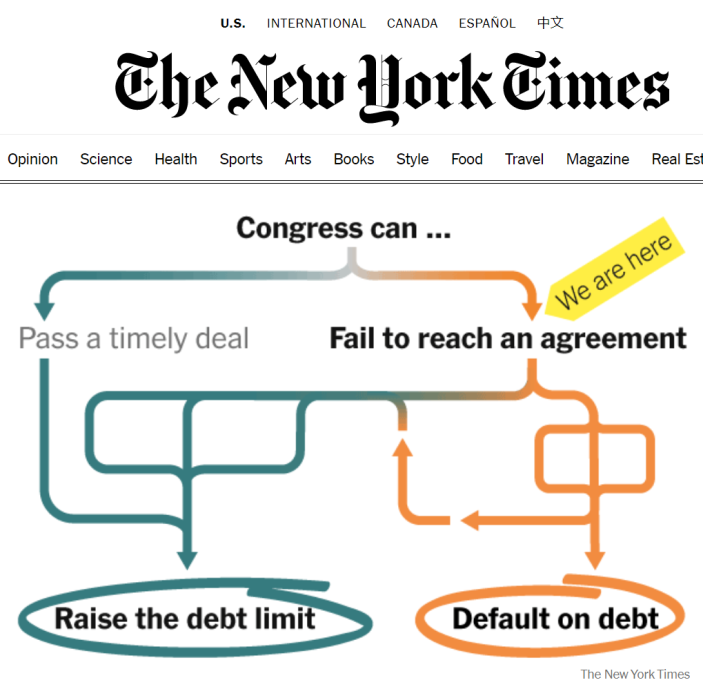

In concert with Biden, scores of media outlets—such as Politico, NPR, CNN, NBC, the New York Times, and the Washington Post—have reported that not raising the debt limit could cause the government to default on its debt. To make sure people get that message, the New York Times recently ran this graphic at the top of its home page:

In reality, however, federal law requires the Treasury to pay the debt, and the federal government has ample revenues to do so. So if there is a default, it will only be because the Biden administration breaks the law.

The federal law that governs the repayment of the national debt states:

(a) The faith of the United States Government is pledged to pay, in legal tender, principal and interest on the obligations of the Government issued under this chapter.

(b) The Secretary of the Treasury shall pay interest due or accrued on the public debt.

The phrases “pledged to pay” and “shall pay” are definitive, unlike discretionary government programs for which money is “appropriated” and is sometimes not even spent.

Moreover, the federal government collected $5.1 trillion of revenues in 2022, while interest on the debt was $775 billion, or roughly 15% of revenues. This reveals that the federal government has plenty of money to service its debt and trillions more for other expenses.

The federal law that requires payment of the debt reinforces the 14th Amendment to the Constitution, which states: “The validity of the public debt of the United States … shall not be questioned.”

Yet in response to a question about the 14th Amendment, Biden press secretary Karine Jean-Pierre claimed that Congress has a “constitutional duty” to raise the debt limit. This turns the plain meaning of the amendment on its head. The 14th Amendment requires the government to honor its existing debt, not to continually take on more debt. It is Biden, not Congress, who is threatening to shirk his constitutional duty to pay the debt unless Congress lets him borrow more money.

Explaining the obvious while debunking tortured legal theories about the debt limit and the 14th Amendment, Michael W. McConnell, the director of the Constitutional Law Center at Stanford Law School, writes:

If Section Four [of the 14th Amendment] has any relevance to the debate, it means that the President is under a constitutional, as well as a pragmatic, obligation to keep current on interest and principal, rather than continuing other spending with a mere statutory basis.

In short, an actual default can only occur if the President disregards a federal law that supports the Constitution he has sworn to uphold.

Without presenting any evidence to support their claims, some organizations and individuals have asserted that the Treasury doesn’t have the legal authority to prioritize paying the debt before other expenses in the event of debt limit impasse.

Some examples include the Center on Budget and Policy Priorities, columnist Jamelle Bouie, and Max Baucus a former U.S. Senator from Montana who is now Biden’s ambassador to China. During a floor speech in the Senate, Baucus declared:

The Treasury has no legal authority to prioritize spending and pay only the most important bills.

Baucus’s statement is in conflict with “the supreme law of the land,” otherwise known as the U.S. Constitution. As documented by Ph.D. David Upham, the Director of Legal Studies at the University of Dallas, the Constitution explicitly requires federal officials to perform specific functions like:

Since all of these constitutional “duties to act involve a duty to spend money,” writes Upham, the government is required to “prioritize” spending on them if the debt limit is maxed out.

Likewise, liberal icon and Harvard law professor Laurence Tribe explained during an Obama-era debt limit standoff that the president:

This past Sunday, the New York Times published an op-ed by Tribe in which he pulls a 180 on this issue and declares “I changed my mind” and Biden can order the Treasury to “borrow more than Congress has said it can.” He admits that this would require the president to ignore the debt limit law but argues that:

However, Tribe himself dismantled those very same arguments in a 2011 essay, and his Times op-ed rebuts none of the points he raised. These include but are not limited to the following:

In his recent backflip, Tribe also claims that “ignoring” the debt limit wouldn’t “represent a dangerous step in a tyrannical direction.” This is at odds with emails he sent to a high-ranking Treasury official in 2011. In this exchange, Tribe addressed the possibility of Obama using the same justification Tribe endorsed in his 2023 Times’ op-ed and wrote that it would set “a genuinely dangerous precedent of ignoring the rule of law.”

Another excuse as to why the federal government can’t prioritize spending on the debt is that the Treasury is incapable of doing this. According to a Treasury Inspector General report during the Obama administration, the Treasury “makes more than 80 million payments per month,” and “Treasury officials determined that there is no fair or sensible way to pick and choose among the many bills that come due every day.”

That claim proved to be false when congressional subpoenas forced the Obama administration to produce documents which revealed that the Treasury:

Beyond those revelations, investigations of this affair yielded admissions that the President is responsible for deciding what gets paid and what does not.

During a congressional hearing, Obama Treasury Secretary Jack Lew was asked if he would “permit a missed payment on a U.S. Treasury security obligation,” and he replied, “It is actually not my decision. It is something that the President would have to decide.”

Likewise, the Treasury Inspector General concluded: “Ultimately, the decision of how Treasury would have operated if the U.S. had exhausted its borrowing authority would have been made by the President in consultation with the Secretary of the Treasury.”

Biden maintains that if Republicans don’t go along with his plan to raise the debt limit, they will force the government to default on its debt and to cut payments for popular government programs like Social Security. In reality, these actions would be Biden’s choice alone.

Beyond Biden—organizations and people like CNN, Nancy Pelosi, and NBC News say that not raising the debt limit may cut or stop Social Security payments.

Such an event cannot happen unless Biden unlawfully diverts Social Security revenues to other programs. The finances of the Social Security program are legally separated from the rest of the federal government, making it illegal to spend Social Security taxes on any program other than Social Security. Furthermore, the 2022 Social Security Trustees Report states:

The Social Security Act prohibits payments from the OASI [Old-Age & Survivors Insurance] and DI [Disability Insurance] Trust Funds for any purpose not related to the payment of benefits or administrative costs for the OASDI [Social Security] program.

The fact above also explodes the common myth that the Social Security Trust Fund has been “looted.” Such “looting” is actually a law (established in the original Social Security Act of 1935) that requires the Social Security program to loan all surpluses to the federal government. The government is required to pay back this money with interest, it has never failed to do so, and it has been doing this since 2010.

Social Security Trust Fund assets are comprised entirely of federal government debt. The Treasury’s obligation to pay the interest and principle on this debt is covered by the same law that requires it to pay for all other debt.

As such, Professor McConnell writes, “Social Security payments are not jeopardized by hitting the ceiling.” However, they could be jeopardized by a president who violates the law.

According to Cal Berkeley professor Robert Reich, the debt ceiling “serves absolutely no purpose” and should be abolished. Likewise, the New York Times editorial board claims the debt limit “has not served a useful purpose in living memory.”

Just the opposite, the debt limit serves several purposes, two of the most important being transparency and accountability.

Politicians routinely enact thousands of pages of complex laws with rhetoric about saving money, cutting the deficit, and investing in America. Joe Biden’s Twitter feed is heavily laced with such statements.

Yet contrary to his talk of fiscal responsibility, Biden and the Democratsraised the debt ceiling by $2.5 trillion less than a year and half ago and are now pushing to raise it again. Such votes provide public visibility into the actual state of federal finances and who is driving it deeper into debt.

Without debt limit votes, people like Hakeem Jeffries, leader of the House Democrats, can easily pull the wool over voters’ eyes with claims like this: “President Biden and House Dems have cut the deficit by $1.7 trillion over the last two years.” In reality, their actions increased federal deficits by about $840 billion over that period, but understanding this takes knowledge of the following details:

Votes to raise the debt limit are obvious and give voters information to hold politicians accountable. That said, they could still be twisted by unscrupulous journalists and activists. One way to do this would be to blame a party for voting to increase the limit while failing to mention that their opponents voted against the bill because they wanted to increase the limit even more.

Another important purpose of the debt limit is to prevent previous presidents and congresses from racking up bills while forcing future presidents and congresses to pick up the tab.

For a recent example, one month before Republicans took control of the House in January 2023, a lame-duck Congress and Biden passed an omnibus spending bill that spends $1.7 trillion and spans 4,155-pages. Democrat Rosa DeLauro of CT called it the greatest increase in “non-defense funding ever” and boasted that it “fulfills 98% of Democratic Member requests in the House.” The politicians who voted for this could have raised the debt limit in the same bill, but instead, they left that to the new Congress while saddling it with all of the spending they passed.

On a much larger scale, previous congresses and presidents have enacted large mandatory programs with perpetual authority to spend money, like Medicare, Medicaid, Food Stamps, and other social programs. The share of the federal budget consumed by these programs has grown from about 30% in the early 1970s to more than 60% today.

Mandatory programs have become such an engrained part of government spending that politicians sometimes ignore these outlays when speaking about the federal budget.

The debt limit gives voters and lawmakers a measure of control over the spending that occurs under their watch, even if they don’t simultaneously control both houses of Congress and the presidency.

A common talking point of people who want to violate or eliminate the debt ceiling is that “Congress has already voted to spend this money” and not spending it would be “breaking promises.” What they fail to mention is that the current Congress didn’t vote to “spend this money,” and the previous congresses that made these “promises” didn’t provide enough revenues to pay for them.

Like other aspects of the debt limit debate, popular narratives about why the national debt has become so massive are false. Two of the most common are that tax cuts and military spending are largely to blame.

Contradicting those claims, the share of the U.S. economy collected in federal taxes has been roughly level for 80+ years, and military spending has plummeted from 53% of government outlays in 1960 to only 13% in 2021.

The main driver of the debt is federal spending, which has grown from 3% of the U.S. economy in 1930 to 24% in 2022. This spending is primarily due to social programs, which rose from 21% of federal outlays in 1960 to 73% in 2021.

Naturally, ardent proponents of those debt-inducing programs are trying to raise the debt ceiling, eradicate it, or ignore it. Their arguments, however, are rife with deceit. Contrary to what they claim:

James D. Agresti is the president of Just Facts, a research institute dedicated to publishing facts about public policies and teaching research skills.